YOUR EDGE. OUR FUNDING.

We specialize in value-driven structured capital for transformative initiatives. $100+ million fundings.

Hybrid debt & equity.

Strategy

Access Capital:

- Structured private credit with equity convexity

- Adaptive mezzanine capital with risk-adjusted returns

- Customized terms for tenor (up to 7 years), coupon (can be low), conversion (can be high)

- Dynamic funding, for example, in structured convertible preferred equity solutions to unlock value in complex situations—such as shareholder buyouts, strategic M&A, asset and land monetization, or greenfield expansion.

Access Capital convenes funding for structured solutions where others cannot. Flexible capital for local strategies. Rising corporates can now access global financial strength for expansion, restructuring, and buyouts.

Funding

Funding your Special Situations

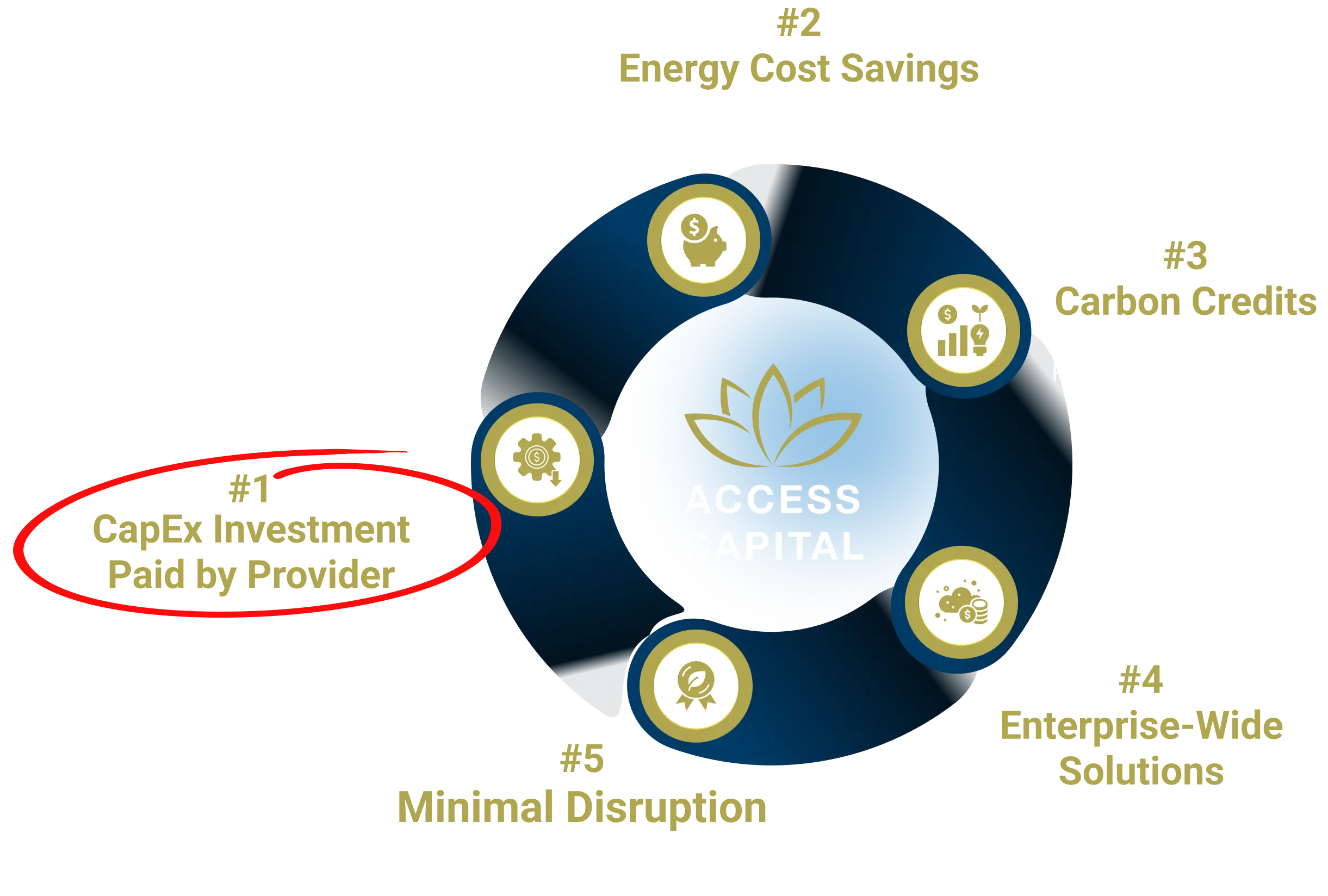

Net-Zero Delivery

Access Capital partnership with (ex)World Bank team delivers decarbonization and energy savings solutions, covers all design and CapEx costs, and provides integrated carbon credit expertise

About us

Darryl James Dong, Principal

Darryl J. Dong is the Founder and Principal of Access Capital, a Hong Kong–based investment and advisory platform focused on large-scale, structured capital solutions across Southeast Asia. He partners with leading institutional investors to unlock value in special situations, providing strategic capital to multi-line corporates pursuing transformative opportunities.

Prior to founding Access Capital, Darryl held senior leadership roles at the International Finance Corporation (IFC), the private sector investment arm of the World Bank. As Head of Office in Ho Chi Minh City, he led IFC’s strategy, origination, and stakeholder engagement in Vietnam, overseeing business development and regional platform creation. Earlier, as IFC Client Leader in Singapore, he managed strategic accounts and regional capital mobilization across Asia. Darryl brings over 40 years of cross-border investment and financing experience, including the last 25 years in Asia and an earlier 15 years in the U.S. He previously led GE Capital’s distressed investment platform in Asia from Tokyo and spent nearly a decade in Hong Kong building AIG’s global special situations business. His early career in the U.S. centered on corporate restructuring and capital markets execution.

He holds a degree in Civil Engineering from the University of British Columbia and dual MBAs in Project Management and Corporate Finance.

Tony Tse, Partner

Tony is a Partner at Access Capital and a senior financial executive with over 30 years of global experience across capital markets, banking, and digital finance. He is recognized for his deep connectivity with the institutional investment community and his forward-leaning leadership in emerging sectors, including digital assets and crypto finance.

Before joining Access Capital, Tony held senior leadership roles at Goldman Sachs, Jefferies, Royal Bank of Canada, and more recently was part of the senior executive team at the TMX (Toronto & Montreal Exchange) Group.

He leads global cross-functional teams in banking, exchanges, capital markets, and digital assets. He currently serves as an independent board director for several early-stage crypto and payment companies.

Tony holds a Bachelor of Commerce degree in Finance and Marketing from McGill University, Montreal. He is based in Hong Kong and supports Access Capital’s regional fundraising activities for businesses and projects.

Amy Kulboon, Partner

Khun Amy has over 20 years of experience working in client-facing roles, as well as financial analytics, with Thai corporates and multinational investment firms.

Amy has a proven track record of raising capital for structured debt and equity transactions for her clients in tailored structures to help monetize “stuck” opportunities.

Her span of mandates includes bank financings, special situation structured fundings, pre-IPO investments, procurement of strategic partners, cross - border tax planning, and project management across manufacturing, property, and hospitality sectors.

She has a wide and deep network of private credit and private equity capital providers, many which are exclusive partnership arrangements. She is based in Bangkok and supports Access Capital’s Thailand fundraising activities for businesses and projects.

Chris Trung Vo, Associate

Chris has over 15 years of professional experience across accounting, auditing, corporate finance, and investments. He brings a comprehensive and strategic perspective to business leadership. He has held key roles in top-tier consumer distribution and maritime products management firms, demonstrating a strong track record in corporate finance and operational performance.

His investment experience spans public equities with a leading asset management firm, as well as private equity mandates with a regional fund, where he was actively involved in M&A transactions and investor relations across sectors including real estate, education, and energy.

Chris has served as CFO and COO for private companies, overseeing financial strategy and operational execution. He has successfully passed CFA Level II and continues to apply a disciplined, analytical approach to driving value creation and sustainable growth. He is based in Ho Chi Minh City and supports Access Capital’s regional fundraising activities for businesses and projects.